We have had a lot of questions asking about home loan interest rates and whether it is worthwhile fixing them in place. It’s definitely an option that bears some merit, but one of the usual questions/statements made is along the lines of “if I get the variable option, it’s not going to go up that quickly, is it?”

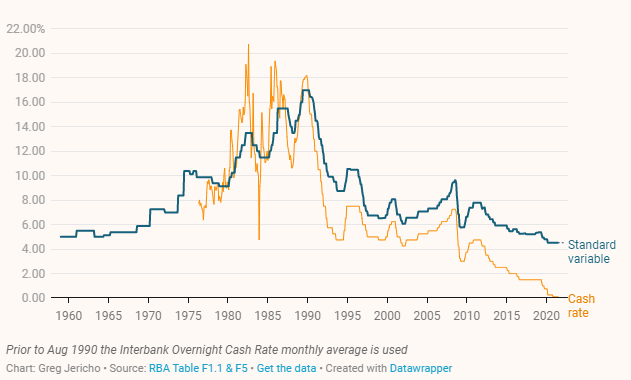

As the headline picture shows, interest rates have certainly had times where they have shot up remarkably quickly (here’s looking at you GFC), with a rate rise of over 1% over the course of 2 years.

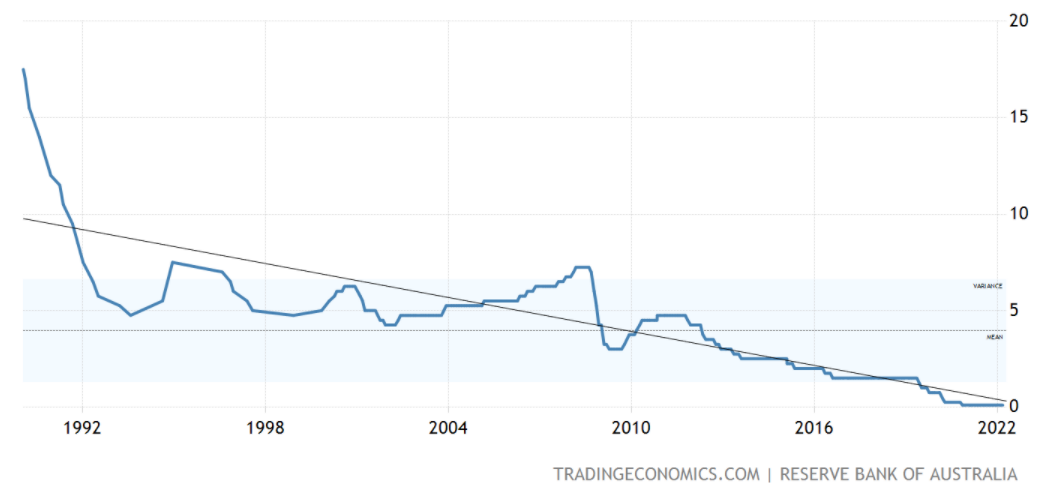

Interest rates don’t always rise quickly, as can be seen from the gradual increase from the early 2000’s to 2008. Banks often charge a small premium to their clients for fixing their interest rate (and certainty), but this premium doesn’t always demonstrate good value for borrowers. We can’t rely on past history to guide our decisions, but it is interesting that interest rates for the past 30 years have shown that most rate increases have ended up being short term and have generally trended downwards.

A word of caution, however, as the 70’s and 80’s showed us that when things go wrong, they can go spectacularly wrong!

At the end of the day, getting the right loan isn’t always about rates. Everyone’s situation is unique, which is why getting advice is crucial to giving you peace of mind.

If you would like to speak with our in-house mortgage broker, Andrew, who will provide you with home loan options tailored to you, please give him a call on 08 9240 7629 or email andrew@taxproaustralia.com.au

Leave A Comment