What can our tax accountants do for you?

Expert Tax Accountants in Perth

Our team of tax accountants make the accounting process simple, so you can focus your time on doing what you do, better. Whether you need to lodge a tax return, start a business, or require on-going support with your accounts, we crunch the numbers and don’t let opportunities pass you by.

What our clients say

Taxpro always takes the time to explain everything to us so we fully understand how we are going financially and with this information we have been able to grow our business to what it is today.

What I really appreciated most, is I can simply text, email or phone any time if I need advice or support and the job was never too small or too complicated for Joseph and the staff at Taxpro.

Latest news

Stay up to date with all our latest news, guidance and regulatory information from our tax accountants here. We like to focus on the practical implications of changes to tax, insurance and financial planning legislation as well as offering insights on topical issues relevant to our clients.

JobKeeper subsidy NOT included in aggregated turnover

When the JobKeeper subsidy was first announced, it stated that the payments received by an employer would be included in the employer's assessable income as wage subsidies, but not subject to GST. Therefore, it is classed as ‘ordinary income’. Ordinary proceeds from business activities that are carried on regularly and in an organised, systematic way, on a large scale or with view to profit, are classed as ordinary income. Last week, the Tax Practitioners Stewardship Group pressed the ATO for clarification on the Jobkeeper payments. If they are classed as ‘ordinary income’, would it be included in aggregated turnover? This could result in the loss of a range of small business concessions based on aggregated turnover thresholds. Small business concessions include: Small business income tax concessions Small business CGT concessions Instant asset write-off Refundable R&D tax offset Base rate entity tax rate We are pleased that the ATO has now confirmed that while the payments are classed as ordinary income, they are not derived in the ordinary course of business, and therefore will NOT be included in aggregated turnover. This should put small business owners mind at rest, that they will not [...]

REMINDER: Government’s Super Guarantee Amnesty ends today!

Are you a business with Super Guarantee (SG) liabilities? Introduced on 6 March 2020, the Australian Tax Office’s Super Guarantee Amnesty lets business owners disclose and pay previously unpaid super guarantee charges (SGC), including nominal interest, they owe their employees, for quarter(s) starting from 1 July 1992 to 31 March 2018, without incurring super guarantee charges (SGC) or penalties. The super guarantee charges can be substantial: There is an administration fee of $20 per employee, per quarter If you were late submitting your SGC statement, or failed to do so, you will be liable for the Part 7 penalty - the minimum penalty is 100% of the SGC and the maximum is 200%! You will pay nominal interest (10%) A general interest charge (GIC) will also be applied Employers will be unable to claim a tax deduction for the SGC paid You will also have to pay the outstanding Super Guarantee The ATO has given a good example of a small business that failed to take the Super Guarantee Amnesty. Following an audit by the ATO, a salon owner discovered they had a SG shortfall and the total [...]

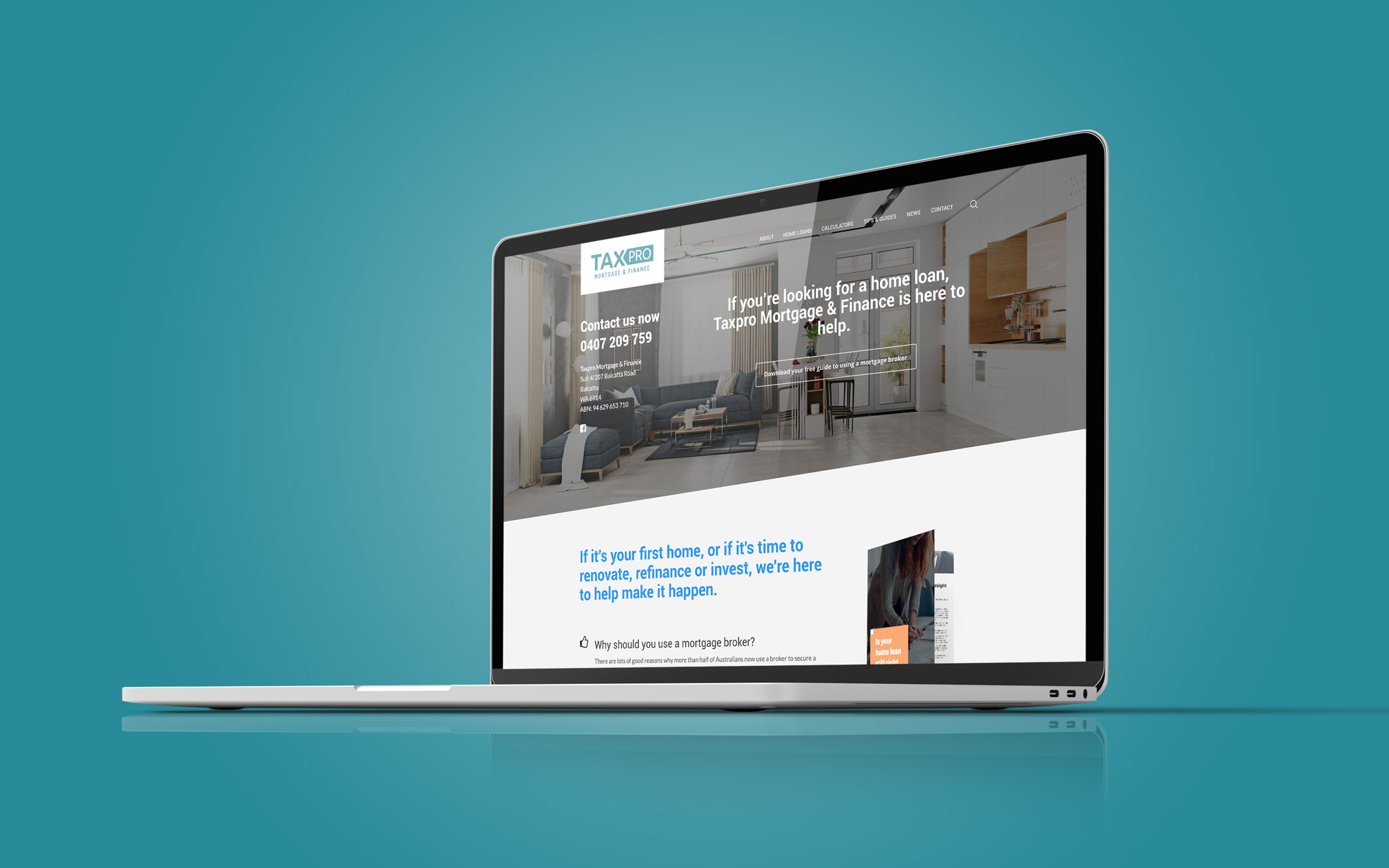

A wealth of home loan resources at your fingertips!

We are delighted to launch our new Mortgage and Finance microsite that gives you a wealth of home loan resources at your fingertips! Whether you are looking to purchase your first home, re-mortgage to get a better deal, or buy an investment property, you could spend hours researching and still feel confused. The M&F landscape is always moving, so to help guide you through the home loan process, we have a number of very useful resources that will give you the knowledge to make an informed decision. Selecting the right lender is crucial in planning your future, so we work closely with you to understand your needs from the start, to find you the best deal. We offer impartial advice, so we don’t favour one lender over another. We search the whole market to source the right products for you and then negotiate with the lenders on your behalf to facilitate them competing for your business. FREE guides Get started with valuable information and advice on what you need to do to secure the loan your property. Becoming a first home buyer Refinancing your home [...]

Our partners

CALL US

08 9240 7629

EMAIL US

VISIT US